Should I buy a house during a pandemic?

Written by:

Patrick Boyaggi

Patrick Boyaggi

CEO an Co-Founder

Patrick is the Co-Founder and CEO of Own Up. He has a wealth of experience and knowledge as a mortgage executive.

See full bio

Making any big decision, financial or otherwise, always involves accepting a degree of uncertainty – even when things are “normal.” Carefully laid plans that made sense just a few weeks ago are now being re-examined or scrapped altogether. The effect of all of those changing plans on the economy has been profound. The truth is, during times like these we are all trying our best to make sense of new risks and opportunities.

If you were preparing to get into the housing market before the recent COVID-19 related upheaval, you might be thinking about putting your plans on hold. Or perhaps you’re sensing an opportunity to accelerate your timeline for purchase. Regardless of which camp you’re in, you're not alone. According to a Meyers Research study of Google searches, "Should I buy a house?" recently reached an all-time high. Here’s a framework to help think through this important decision:

The Pros and Cons of today’s housing market

Pros:

- Interest rates for mortgages are near all-time lows, which means you will have lower monthly mortgage payments and more buying power than during periods of high-interest rates. With average rates almost 1% lower than last year, the monthly payment on a $250,000 mortgage drops by $144 (from $1,266 to $1,122 per month).

- US housing rents are near all-time highs, making homeownership financially more attractive than paying rent, especially if you’re looking at a long-term lease.

Cons:

- The supply of homes for sale in the US has fallen to the lowest level since 2012, making it challenging to find homes and turning most listings into a competitive bidding process. These conditions are associated with a ‘seller’s market’ and tend to drive higher prices.

- The S&P 500, a stock market index that measures the performance of 500 large companies listed on stock exchanges, has experienced the sharpest decline in nine years. The bull market, which began in 2009, is officially over, and trillions of dollars of wealth have been erased in a matter of weeks.

Your personal financial situation

Every homebuyer journey is unique – a sometimes complex set of changing circumstances that add up to a decision. Helping clients navigate that process is one of the reasons I love my job. Regardless of your circumstance, there are several considerations when approaching the question of homeownership that make sense for everyone to evaluate:

- How will I pay for the down payment? If you’ve been saving cash to buy a house your decision to buy should not be altered too much by the turmoil in the financial markets. Alternatively, if your savings are in investment accounts, you may want to re-evaluate things. The stock market has experienced double-digit percentage declines, so if you feel uncomfortable getting out of the market now at its current rate to come up with a down payment, you may want to hold off for the time being.

- How much do I have for a downpayment, and how long am I planning on living in my home? If you have enough saved away to put more than 10% down, you can more confidently proceed with the home buying process. However, if you are planning to use a low down payment loan program, you may want to wait to see how the housing market responds to the recent economic turmoil. For example, if you only put 3% down, and housing prices depreciate by more than 3%, you can find yourself underwater. If you are purchasing your home for a longer-term (10+ years) though, short term home price fluctuations become less of a factor.

- How do you feel about your job security? If you’re feeling particularly wary about job security, or you’re in an industry that has been severely affected by the recent economic downturn, it may be best to wait and see how the economy evolves. Most homeowners rely on their employment income to make their mortgage payments, and lenders require you to have a job in order to qualify for financing unless you have regular income from another source.

- Are other life events forcing you to make a housing decision in the near term? Some people are forced to move because of a life event, such as relocating for a new job or having a child. If that’s the case, it’s best to weigh the costs and feasibility of renting, in addition to the aforementioned questions of job security and overall financial standing. If you feel comfortable with your answers to those questions, and you’re buying a home makes the most sense, you should feel confident proceeding.

How we help homeowners navigate uncertainty

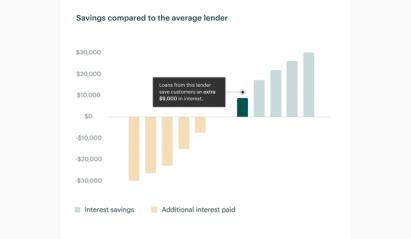

We started Own Up to empower home buyers with personalized data and unbiased advice so they can make the best financial decisions for their unique situation. Our technology lets borrowers anonymously compare firm, custom rate quotes and total costs across a variety of mortgage products and lenders, while our expert Home Advisors serve as customer advocates to answer questions and help explore each option.

Our uniquely transparent business model is in perfect alignment with the customer, so we are only incentivized to act in your best interest, not ours. We give customers honest, expert advice – whether that means choosing a home financing option from one of our certified lenders, going with a lender outside of our marketplace, or even holding off on purchasing altogether. Our service is free to use, there are no obligations, and we keep your personal information completely confidential, so you don’t have to worry about a barrage of sales calls and emails from lenders trying to get your business.

If you've had a consult with a home advisor in the past and you want to reconnect, email us at hello@ownup.com and we'll get a call scheduled to discuss the historically low rate landscape and your current financing options.

If you're new to Own Up, take our five-minute questionnaire to build your profile and schedule a call with an expert Home Advisor to get started.