Introducing Lender Grader, a tool to help borrowers understand the mortgage market

Written by:

Own Up Staff

Own Up is a privately held, Boston-based fintech startup that is on a mission to make sure every home buyer receives a fair deal on their mortgage by unconditionally empowering individuals with customized data, personalized advice, and unprecedented access to mortgage lenders to create better financial outcomes and simplify the home financing experience.

See full bio

Summary

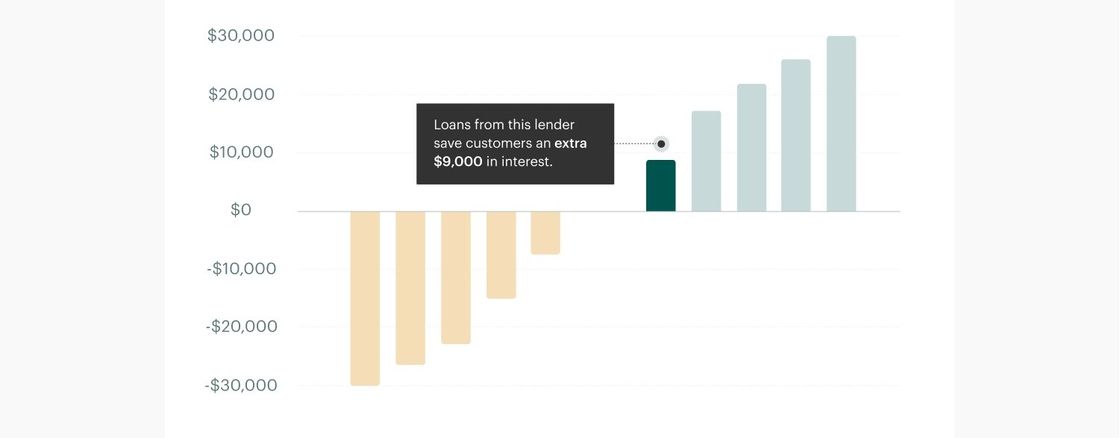

- Lender Grader helps borrowers understand how rates vary between different lenders for the same loan scenario

- Lender Grader uses publicly available data to analyze lender performance – use the tool to see how lenders compare against the state average

According to the National Survey of Mortgage Originations, a joint project by the Federal Housing Finance Agency and the Consumer Financial Protection Bureau, most borrowers think that “prices are roughly the same” across mortgage lenders. They’re not – prices vary widely across different lenders for similar loan scenarios.

We’re excited to launch the first version of Lender Grader, a free, easy-to-use tool that helps anyone visualize and understand just how much rates vary from lender to lender, and what that might mean for their bottom line.

Putting data to work for borrowers

Lender Grader is powered by data made available through the Home Mortgage Disclosure Act (HMDA). HMDA was enacted by Congress in 1975 and mandated mortgage lenders maintain and publish records regarding the pricing of the loans they originate. As the most comprehensive publicly available information on the mortgage market, HMDA data helps the Consumer Finance Protection Bureau identify predatory or discriminatory lending practices, and analyze trends in home lending across geographic and demographic factors. We built Lender Grader as a way to bring greater transparency to that data and create actionable insights that empower borrowers to achieve better financial outcomes.

Here’s how it works:

Select a state, a lender, and optional data filters like loan size, term, or product type to produce an analysis for that given borrowing scenario. The analysis grades the lender, showing how the average rate they gave for that scenario compares to the average rate given by other lenders in the same state for that same scenario.

Whether you're evaluating a current lender, narrowing down a list of preferred lenders, or just exploring the data, Lender Grader provides insight into the disparity of rates for a given scenario. While there’s still more to dig into what makes “the best” or “worst” lenders, Lender Grader works as a starting place for borrowers to understand average lender performance. These grades represent the average rate given for that particular lender, and rates vary within lenders, even for similar scenarios.

Behind the numbers

In the 2019 HMDA data, which is the most recent data set published by the CFPB, 5,496 lenders reported 8.1 million loan originations—representing 88% of the total estimated loan originations in the U.S. Lender Grader analyzes mortgage issued by 3,452 lenders, looking only at lenders that originated 100 or more loans to reduce statistical noise that made comparisons between lenders less accurate.

Why rates vary

Whenever there’s an asymmetry of information between two parties in a financial transaction, the side with more information has an advantage. It’s no different in the mortgage industry.

“The primary market, where a borrower decides which lender they use – whether they go to a mortgage company, a bank, or a credit union – is incredibly opaque,” says Patrick Boyaggi, CEO of Own Up. “Lenders have access to all of this information about what rates they can charge their customers, and consumers have access to relatively little information about what a fair deal looks like.”

On the other side of the transaction, you have the borrower, often overwhelmed and uninformed or misinformed, and about how the whole process works. "Our belief is that transparency and empowering borrowers with data is the way that you really level the playing field," he says.

That opacity is an advantage for lenders, creating the opportunity to charge above market rates and fees, increasing profits. The combination of factors that inform what terms a lender offers a borrower are complex and variable. Some of those factors are the same across borrowers’ scenarios, like loan size, credit score, and loan-to-value ratio, but each lender may interpret and price loans according to those factors differently. Then there are factors unique to the business model of each lender that influence the terms they offer, like the compensation of their loan officers, their operating model, and the profitability targets they set.

“Think of it this way," Boyaggi says. "If a car dealer wanted to sell a lot of cars and make a small profit on each car, they can offer a lower price to buyers. Another way to operate would be to make a large profit on each car. In either way, it’s up to the owner of that business to decide how they want to operate. Mortgage lending is really not that different."

The bottom line

A mortgage is often the largest financial transaction of the borrowers’ life. Even a quarter of a percentage point in rate can mean thousands of dollars over the life of the loan. Fees and other costs can also vary widely across lenders and loan products.

Shopping for a mortgage is a critical step in the homeownership journey, but it’s unnecessarily difficult. Simple online searches and “lead-generation” websites don’t turn up personalized, accurate quotes, and rates change daily. Borrowers should always compare accurate, detailed offers from multiple lenders, and use those competing offers to negotiate.

We built Own Up to take the hassle out of getting fair terms, using a single, short application to access a marketplace of lenders and compare pre-negotiated offers across that marketplace. We’re excited to keep building Lender Grader and other tools that put data to work to give borrowers the insights they need to make better home financing choices.