Never overpay on your mortgage

Own Up’s personalized mortgage shopping service finds the perfect mortgage fit for you

Save Money

Shop like a pro. Be confident that you can beat the market and save thousands.

Save Time

Own Up uses AI to curate top-rated mortgage lenders so you can find a great deal—fast.

Peace of Mind

Let our expertise work for you. Know for sure that you won’t get taken advantage of.

Why customers love us

“If I had a question, Patrick was just a phone call or text away.”

Andrew recently had an offer accepted on an affordable housing unit, but due to the condo’s unique circumstance...

Andrew

“There was a human touch...it felt like a concierge.”

Michael and his wife were living and working in the greater Boston area when they started to think about buying a home...

Michael & Marina

“They got us the preapproval in like 10 minutes! They absolutely saved the day.”

Own Up matched them to a lender at a preferred interest rate, saving them $38,000 over the life of their loan...

Emily & Evan

“If I had a question, Patrick was just a phone call or text away.”

Andrew recently had an offer accepted on an affordable housing unit, but due to the condo’s unique circumstance...

Andrew

“There was a human touch...it felt like a concierge.”

Michael and his wife were living and working in the greater Boston area when they started to think about buying a home...

Michael & Marina

“They got us the preapproval in like 10 minutes! They absolutely saved the day.”

Own Up matched them to a lender at a preferred interest rate, saving them $38,000 over the life of their loan...

Emily & Evan

The benefits of shopping with us

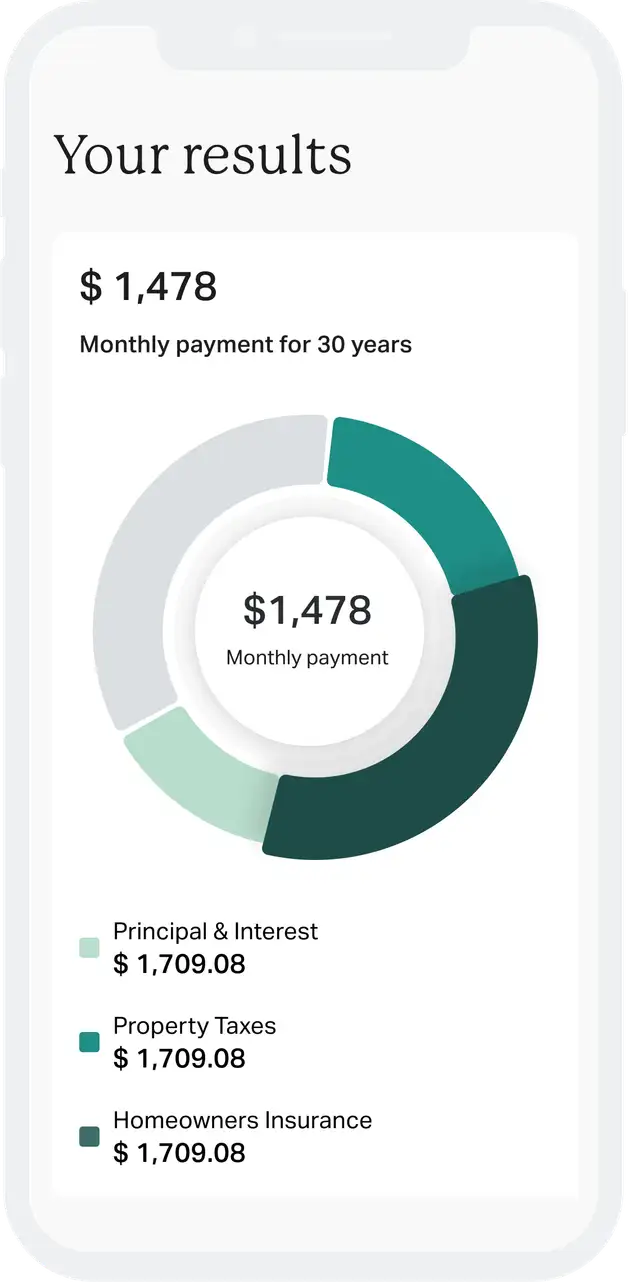

Customers consistently save an average of $28,000 over the life of their loan.1

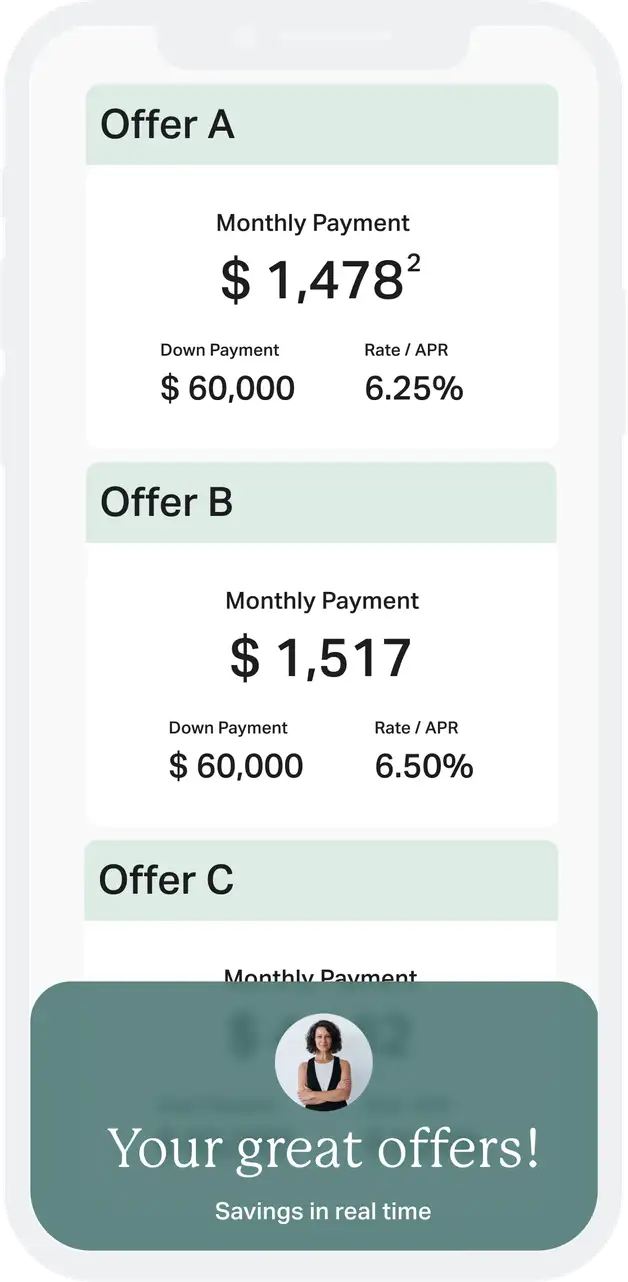

Top-rated lenders across the country will compete for your business.

It’s simple and easy. A great mortgage rate is just a few clicks away.

Knowledge content, powerful tools, and unbiased advice empower you to make better-informed decisions.

No hard credit checks. No sales pressure. And our service is completely free to use!

We work with top-rated lenders