Honest About Money

Written by:

Patrick Boyaggi

Patrick Boyaggi

CEO an Co-Founder

Patrick is the Co-Founder and CEO of Own Up. He has a wealth of experience and knowledge as a mortgage executive.

See full bio

One of the core tenants of our business is that we’re honest about money. This means that we tell our customers how we are paid and what it means to them. We do so because transparency is the foundation of a trustworthy relationship. Other companies may claim to be transparent, but we haven’t found another company in the mortgage industry that tells consumers what they are paid.

Specifically, lenders (banks, credit unions and mortgage companies) do not disclose the commission they pay to their Loan Originators nor do they state how much they make when they close a loan. Likewise, lead generation sites, like LendingTree, do not disclose how much they get paid when they sell a customer’s information to a lender or when they post a lender’s rates on their site. Withholding this information is a breach of trust because higher commissions and higher fees result in higher interest rates for consumers. At Own Up, we believe that our customers have the right to know how we are paid and what our compensation is used for.

Therefore, as of September 1, 2020, our lenders will pay us .40% of the loan amount if an Own Up customer closes their loan with them. The minimum fee paid to Own Up is $600 and the max fee is $3,000. We are increasing this fee from .35%. This is the third time that we’ve increased our fee in the history of the company. We've increased our fee to account for the investments we’ve made in technology. Specifically, we’ve enhanced our first-generation software that allows us to pre-qualify customers and accurately match them to the optimal lenders, and we’ve developed APIs that allows us to pull in data in real-time so that we can present customers with market data and personalized loan offers so they can be sure they are getting a fair deal on their mortgage. In addition, these APIs allows us to connect our customers with other products and services related to the home financing experience, for which we may be paid and disclose to every customer.

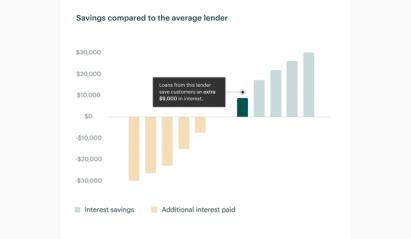

To be clear, homebuyers and homeowners that use our service don’t pay us anything. Although, any fee paid by a lender is ultimately reflected in the interest rates they offer. The fee we charge our lenders remains a fraction of the average commission that lenders pay to their salespeople (most recently 1.04% according to the Mortgage Bankers Association) and the fee they pay to lead generation sites. The lower fee paid to Own Up means that the lenders in our network have excess profit that they are able to return to our customers in the form of lower rates and closing costs, which results in our customers saving tens of thousands of dollars when financing their home.

We are grateful to the tens of thousands of people that have chosen to use Own Up to get a mortgage. We exist to make sure all Americans get a fair deal when securing home financing and we are committed to always doing so in an honest and transparent manner.

This article was originally published in January 2019. It was updated in December 2019 and again in August 2020, to reflect the most current updates to our fee structure.