Announcing Own Up

Written by:

Patrick Boyaggi

Patrick Boyaggi

CEO an Co-Founder

Patrick is the Co-Founder and CEO of Own Up. He has a wealth of experience and knowledge as a mortgage executive.

See full bio

RateGravity is becoming Own Up. We’re thrilled to announce our new name and excited to continue serving homebuyers with a new brand that better represents our company’s values and mission.

When Mike Tassone, Brent Shields, and I started RateGravity in 2016, our name conveyed our goal of lowering mortgage interest rates by bringing efficiency to an inefficient market. But our customers helped us to understand that the name was missing the human element of homeownership. That is to say, everyone wants to own a home, not a loan.

We see all homebuyers as real people with real aspirations and the name Own Up reflects the joy and accomplishment associated with the upward mobility of homeownership. At Own Up, we believe that homeownership is part of the American Dream. It was for my parents, who came to America after meeting overseas while my father was serving in the Vietnam War, and it was for me and my wife when we bought our home after having our first child.

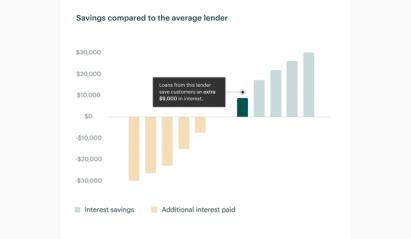

While Own Up better reflects how we help our customers achieve their goal of homeownership, there still is the matter of inefficiencies and inequalities that exists in the mortgage industry. Interest rates can vary between lenders by as much as .50% for the exact same borrower, and misaligned incentives have made this industry exceedingly difficult to navigate as many borrowers pay tens of thousands of dollars more than they should.

As Own Up, we vow that every decision we make will be for the consumer’s best interest above all else. Financing a home is likely the biggest financial transaction in a person’s life, and most people overpay because they don’t have the time, resources, or understanding to find a better deal. At Own Up, that is no longer the case. We’ve knocked down the barriers preventing homebuyers from finding the mortgage they deserve.

Serving our customers is an incredible honor. In 2018 alone, we’ve helped more than 1,200 customers secure mortgages worth more than $650M. We are humbled every day by the reviews from our passionate customers, and we have never been more motivated to continue serving our mission — now officially as Own Up.

- Patrick Boyaggi, Co-Founder and CEO