Why This Own Up Advisor Dedicated His Career To Transparency

Written by:

Patrick Boyaggi

Patrick Boyaggi

CEO an Co-Founder

Patrick is the Co-Founder and CEO of Own Up. He has a wealth of experience and knowledge as a mortgage executive.

See full bio

We sat down with Own Up advisor, Ethan Bernstein, to share some of his wisdom and insight on standing up for consumers. Professor Bernstein is a professor of business administration at Harvard Business School, specializing in “workplace transparency.” Previously, he was tapped by Elizabeth Warren to join the implementation team at the Consumer Financial Protection Bureau as its Deputy Assistant Director for Mortgage Markets and Chief Strategy Officer. We recently caught up with him to learn more about his background and get his perspective on the mortgage industry.

OU: What drew you to work in consumer financial protection?

EB: My very first professor in law school was Elizabeth Warren, and if I had to select one point in time when I decided I was really interested in consumer financial issues, that was it. But, the story doesn’t start and end there.

When I was at Harvard Law School, most people who were interested in restructuring or bankruptcy were interested in Chapter 11 – companies going bankrupt. I actually think that few people find that any stories in law school are more riveting than the ones of failure.

But, while most of my peers were interested in company failures, I found myself, frankly, much more touched and hurt by the personal stories of failure. So, while my peers went off to try and understand how to save companies, I was more interested in the personal bankruptcy side, the consumer side. That’s something that actually did distinguish me and a small group of others.

Later, at The Boston Consulting Group, I happened to do a number of different projects for financial services companies, mostly on their organizational strategies.

So, when then-Special Adviser Warren was asked by President Obama to stand up the Consumer Financial Protection Bureau, I saw a perfect opportunity to combine my interest in the personal stories of failure and my experience consulting with these larger financial services companies.

OU: What moment stands out to you from the establishment of the CFPB?

EB: My first project was focused on the new disclosure form that everyone gets when they are looking for a mortgage. That’s a behavioral question – what information can you give a consumer that will actually fuel decision-making? The mortgage industry is unique because you’re not buying a mortgage, you’re buying a house. So, while the mortgage decision is perhaps the more important one, people focus on it less, especially if they don’t really understand it.

My research background suddenly became useful. We did real social science interviews with people, trying to understand the average person who either had gotten a mortgage recently or was going to be getting a mortgage soon. We learned how they thought about their decision-making and what information in what terms would frame that decision correctly. This could help them get a better deal that would have huge impacts on their financial status for, in some cases, 30 years to come.

OU: What were the most important findings or changes around common-sense disclosure that you feel were the hallmarks of that work?

EB: Our team crowdsourced the answer to your question. We did interviews with people in our traveling lab and put together an initial version of the form. We put that online and said, “What do you think?” We tested it. We tested it some more. We tried another version, we tested it some more. We certainly listened to people who were experts in the field – both financial services organizations and their advisory arms, but also consumer advocate organizations, and those who’d spent a lot of time thinking about this. Ultimately, we opened the data, and it evolved over the course of four or five rounds of testing online. You can actually see how we improved the disclosures on the CFPB website. So, it wasn’t our answer, it was actually theirs, and that’s what made it powerful. That’s what made it right. So, we can try to influence human behavior all we want. In the end, it’s equally important to observe it.

OU: What role do you see startups playing in helping the regulation and protection of the consumer?

EB: When we were standing up the CFPB, we were eager to partner with folks outside government, who had the heart of the consumer in mind.

One group of folks we targeted were startups. We actually had an event in Silicon Valley where we brought FinTech folks together and said, “What can we do to help you?” And they helped me realize that there are things entrepreneurs can do to fix these problems that we couldn’t do.

To me, transparency was a clear problem that startups could help fix. Why do people make bad financial decisions? Usually, it’s because the information does not flow in a way the consumer was expecting, and because the incentives are not aligned to do so. Who is best positioned to fix information flow and incentive structures? Entrepreneurs.

OU: What’s your recollection of meeting with Own Up Co-Founders, Patrick and Mike?

EB: My first thought was, “Are these guys for real?” And they seemed to be for real. This was not just a way to start a traditional mortgage broker with gloss and lipstick on it. They truly wanted to follow a different path, all the way down to the business model.

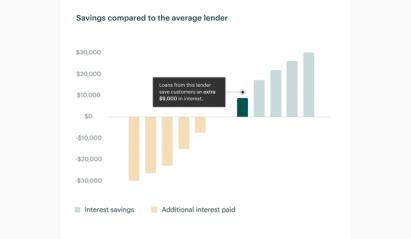

My second thought was, “Why is this going to work when so many others haven’t?” But the answer to that is, look at their background. They’re beautifully aligned to do the specific thing they set out to do – to try and connect individuals with the regional banks and credit unions who don’t typically get access to them at a lower cost than their loan officers can. With the hope that those institutions, when exposed to those clients, can provide a better deal. With these community lenders, you just don’t have the processes that large institutions would have to get in the way. I found that very convincing.

OU: What are the top three things homebuyers should think about before they enter the housing market right now?

EB: One, two, three: Shop, shop, shop. In this day and age, it doesn’t make sense not to shop for your mortgage. Everyone is going to try to convince you not to. Everyone. They’re going to try to convince you it might hurt your credit score, soft inquiry doesn’t. They’re going to try to convince you that you’re not going to have time, that it’s going to expire. It won’t. The more you shop, the more you learn, the more you educate yourself, the more you realize that mortgages – for all the terminology that makes them feel complicated – aren’t complicated.

Until you reach the point where you really understand the product, you haven’t gotten to the point where you’ve really absorbed the value of the process. Trusting someone else who is in your process of buying a home – a realtor, maybe your longtime banker – pretty much anyone other than someone who is truly independent of the process isn’t going to be a good person to listen to. You have to shop, shop, shop yourself. And/or find somebody who will do that, impartially, with you.

OU: CFPB’s statistic is that 47% of homebuyers don’t compare lenders – why?

EB: I don’t know, but I think it’s because they trust someone else more than they trust themselves. They trust someone when they say, “If you shop, that’s going to hurt you.” Or, “I can’t promise you I’ll be able to give this to you if you walk away from it now.” Whatever the message is that works, they trust the message more than they trust themselves.

That was the purpose of setting up an agency that was designed to protect consumers. Maybe consumers would actually trust that we had their best interests at heart, because no other agency ever really has.

The part of this that matters the most, though, is the idea that startups like Own Up are the ones that have the ability to provide transparency to people. Millennials are moving into the phase of their lives where they’re becoming homeowners, and they tend to trust startups more than they trust established organizations. So, a good startup out there, especially in the current environment, might be able to have more impact than a federal agency or just about anyone else.